Latest News

EARTH’S GOLD NEARING ITS END

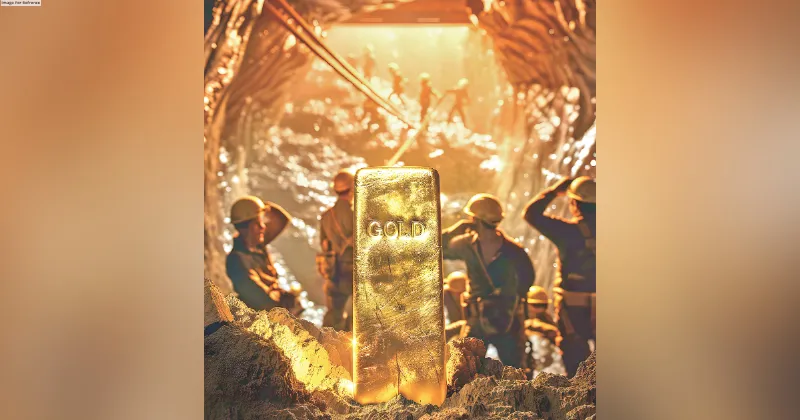

As Diwali approaches, the sparkle of gold is everywhere, with families rushing to buy jewellery, coins, and even small trinkets to mark the festive season. Yet beneath the surface of this glittering tradition, a pressing question looms: What happens when the gold runs out? For centuries, gold has been a symbol of wealth, power, and celebration, particularly in India, where festivals like Diwali see a surge in gold purchases. But as Earth’s underground gold reserves inch closer to depletion, the world must face a reality where this precious metal becomes more scarce— and more expensive—than ever before.

With demand consistently outpacing supply, particularly in the jewellery industry, the future of gold may soon shift from a symbol of prosperity to a luxury accessible only to the wealthy. As we mine the last of our reserves, experts predict a dramatic increase in gold prices, a change that could upend industries and traditions alike. This Diwali, while the gold shines brighter than ever, it might also serve as a reminder that we are nearing the end of an era.

Unlike diamonds or gemstones, gold is a nonrenewable resource—once it’s gone, it’s gone.

At present, the world relies heavily on existing reserves to satisfy demand. But with these reserves dwindling, the repercussions will be felt across various sectors, particularly in the jewellery industry, which accounts for around 50% of global gold consumption (World Gold Council, 2018). So, what does a future without easily accessible gold look like, and how will industries adapt?

THE LIMITS OF A FINITE RESOURCE

Gold, like silver and platinum, is a finite natural resource. Although the Earth gains trace amounts of gold from meteoric dust, the total amount is effectively fixed. Once underground reserves become exhausted—or too costly to extract—the supply-demand balance will shift dramatically.

The jewellery industry will feel the impact most. As demand outstrips supply, prices are expected to soar. Some experts suggest that gold could reach as much as USD $10,000- $13,000 per ounce in today’s terms. Should this come to pass, the economic landscape of the industry will change significantly. Lower-carat gold jewellery, once a more affordable option, may become a luxury accessible only to the wealthy.

WHEN WILL GOLD RUN OUT?

Some estimates suggest that the world could run out of minable gold by 2050. The U.S. Geological Survey estimates that approximately 2,40,000 tonnes of gold have already been extracted, with roughly 50,000 tonnes of reserves remaining. Given that around 3,000 tonnes of new gold are mined annually, it’s plausible that gold mining could grind to a halt by the middle of this century.

SILVER AND PLATINUM: A SIMILAR FATE

While gold reserves may run dry first, silver and platinum group metals (PGMs) are not far behind. The U.S. Geological Survey estimates there are about 530,000 tonnes of silver left in the Earth’s crust, which at the current mining rate of 25,000 tonnes annually, provides only about 20 more years of supply. Like gold, silver will become increasingly scarce, driving up prices and creating a stronger emphasis on recycling.

Platinum and related metals, often used in industrial applications, may have a slightly longer timeline but will ultimately face the same fate as their gold and silver counterparts.

RECYCLING: THE LAST FRONTIER?

As gold prices soar and fresh supply dwindles, the focus will inevitably turn to recycling. Currently, about 30% of the gold supply comes from recycled sources, but as scarcity grows, this figure is likely to rise. Old jewellery, forgotten family heirlooms, and even discarded electronics will become valuable assets as people seek to capitalise on the rising value of gold.

Industrial waste will also take on new significance. Gold, an essential component in many electronics, could become a lucrative resource to recover in a world where new gold is no longer readily available.

THE VIEWS EXPRESSED BY THE AUTHOR ARE PERSONAL

Chandra Prakash The writer works in the Editorial Department at First India in a senior capacity