Latest News

Bajaj Finserv Offers its Existing Customers Pre-approved Personal Loans up to Rs. 10 Lakh

.png)

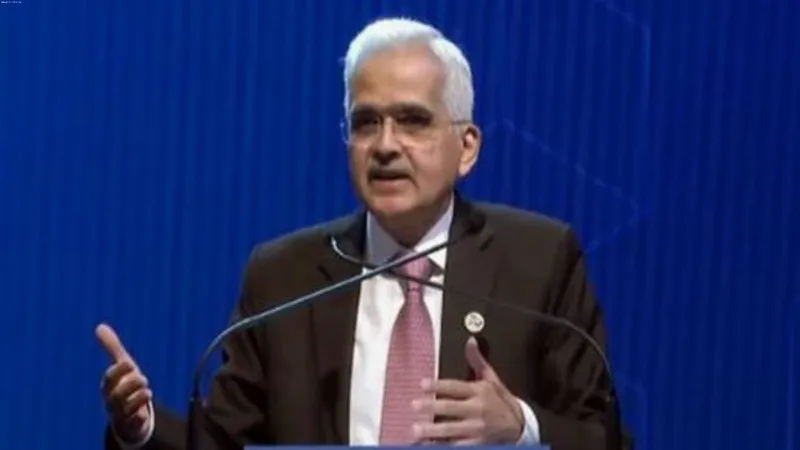

Pune: Bajaj Finserv, through its lending arm Bajaj Finance Limited is offering pre-approved loans to their existing customers to access personal financing in an expedited manner. A pre-approved loan for existing professionals is an ideal borrowing tool for individuals looking for easy or urgent funds without depleting their savings. Such loans come in handy to finance medical exigencies, home repairs, tuition fees for overseas education, and more.

Here is a look at the advantages of availing of a pre-approved personal loan offer from Bajaj Finserv. Borrow up to Rs. 10 lakh

Existing customers of Bajaj Finserv can borrow a minimum of Rs. 20,000 up to Rs. 10 lakh.

Money in bank instantly*

Borrowers get access to funds in just 4 hours.

Better terms and service

Existing borrowers can negotiate for beneficial terms and conditions like getting a larger sanction, extending the tenor, getting the loan without as many formalities, and more.

Hassle-free documentation

Due to their existing relationship with the lender, Bajaj Finserv customers require only a few documents to complete the application process. This helps them avail quick loan disbursal from the lender. Sometimes, no documentation is needed from the customer and a 100 percent online loan process basis their offer from the company.

Affordable interest rate

As lenders already know the creditworthiness of their target customers for these offers, they usually provide a more affordable personal loan interest rate. As a result, taking a loan doesn't stress finances, and applicants can repay comfortably.

Flexible tenor

For repaying their loan, borrowers can choose from a tenor ranging from 24 to 60 months as per their convenience.

Zero hidden charge

The pre-approved loan has no hidden costs. Bajaj Finserv offers complete transparency with all loan proceedings, terms, and conditions.

Steps to avail of Bajaj Finserv Pre-Approved Loan

- Click on the application form on the Bajaj Finserv website.

- Login by entering the OTP sent to the user's phone number

- Check the pre-approved loan offer

- Verify loan details and pick a suitable tenor

- Check the entered details and complete the online process

On completing these quick and easy steps, customers can easily borrow money online.

In addition, customers can also check their pre-approved personal loan via the customer portal - Experia or via the Bajaj Finserv App. With all this information at their disposal, borrowers can conveniently apply for a pre-approved loan for existing applicants and get a large sanction of up to Rs. 10 lakh. With a Bajaj Finserv Pre-Approved Loan, customers can enjoy same-day disbursal facilities. The personal loan EMI calculator can be of great help in this regard. To get started, enter a few details to check the pre-approved offer and access funds in no time.

Bajaj Finance Limited, the lending company of the Bajaj Finserv group, is one of the most diversified NBFCs in the Indian market, catering to more than 45 million customers across the country. Headquartered in Pune, the company's product offering includes Consumer Durable Loans, Lifecare Finance, Lifestyle Finance, Digital Product Finance, Personal Loans, Loan against Property, Small Business Loans, Home loans, Credit Cards, Two-wheeler and Three-wheeler Loans, Commercial lending/SME Loans, Loan against Securities and Rural Finance which includes Gold Loans and Vehicle Refinancing Loans along with Fixed Deposits. Bajaj Finance Limited prides itself on holding the highest credit rating of FAAA/Stable for any NBFC in the country today. It is also the only NBFC in India with the international 'BBB' with a stable outlook for the long-term, by S&P Global Rating.

This story is provided by News Voir. ANI will not be responsible in any way for the content of this article. (ANI/NewsVoir)