The struggle to overcome the downturn begins

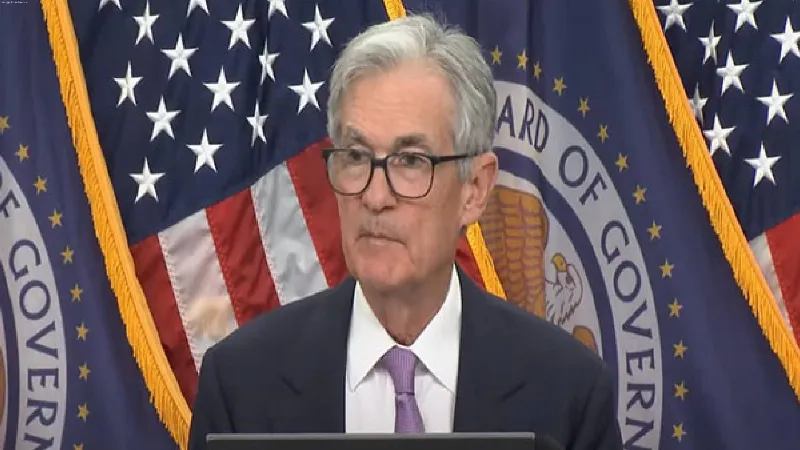

Jaipur: The Indian stock market faced a challenging week, driven by multiple factors such as the Middle East conflict, rising crude oil prices, and heavy selling by Foreign Institutional Investors. Reports indicate FIIs are shifting investments to China amid its economic recovery. New rules for futures and options trading further added to market instability, causing the BSE and NSE indices to drop by around 4.5%, marking the steepest decline since June 2022.

Despite the challenges, there are positive signals for Indian markets, including the RBI’s upcoming monetary policy meeting, foreign reserves crossing $700 billion, festive season business growth, and steady GST collections. However, investors should adopt a “wait and watch” approach before making new decisions.

Last week, the BSE index dropped by 3,883.40 points to 81,688.45, while NSE Nifty fell by 1,164.35 points to 25,014.60. Midcap and smallcap indices also weakened.

FIIs sold stocks worth Rs 40,511.50 crore, while Domestic Institutional Investors (DIIs) bought Rs 33,074.39 crore. On October 3 alone, FIIs offloaded shares worth Rs 15,423 crore. In the bullion market, there was an upward trend in the prices of gold and silver last week, with silver shining brighter.

In Jaipur’s bullion market, the price of 24-carat gold increased by Rs 500 per 10 grams, reaching Rs 77,850 per 10 grams, up from Rs 77,350 the previous Saturday. Silver prices also improved by Rs 2,450 per kilogram, rising from Rs 92,800 to Rs 95,250 per kilogram. Due to the festive season, traders expect further improvement in the prices of gold and silver this week.

Traders expect profit booking to continue due to rising global tensions, crude oil prices, election results in Haryana and J&K, and liquidity concerns from new IPOs.

The RBI’s monetary policy announcement on October 9 may boost public sector banks like SBI, Bank of Baroda, and Federal Bank. If the market recovers, companies like SpiceJet and Zomato could present opportunities. IPO investors should be cautious of high premiums, with new listings like Guru Constructions and 22 others under SEBI’s review.

THE VIEWS EXPRESSED BY THE AUTHOR ARE PERSONAL