Driven by optimism, fireworks continue in stock index

Jaipur: The upward trajectory in the Indian stock market continued last week, driven by a mix of international factors and domestic optimism. In my previous article, I suggested that the Bombay Stock Exchange (BSE) index might surpass 85,000 points before Diwali. Given current trends, it’s plausible that the index could aim for even higher targets by then. However, a crucial question arises: why isn’t the value of shares in investors’ portfolios reflecting index’s gains?

Technical analysts indicate that support levels for the Bombay Stock Exchange (BSE) and Nifty indices are at 82,700 and 25,500, respectively. If the market experiences a decline, investors shouldn’t panic; historically, it tends to rebound after touching these levels.

Yet, it’s important to remember that market booms often lead to profit booking, impacting overall performance. Savvy investors should regularly assess their portfolios and consider booking profits when share values exceed targets. Real gains manifest as cash in bank accounts, not just portfolio values.

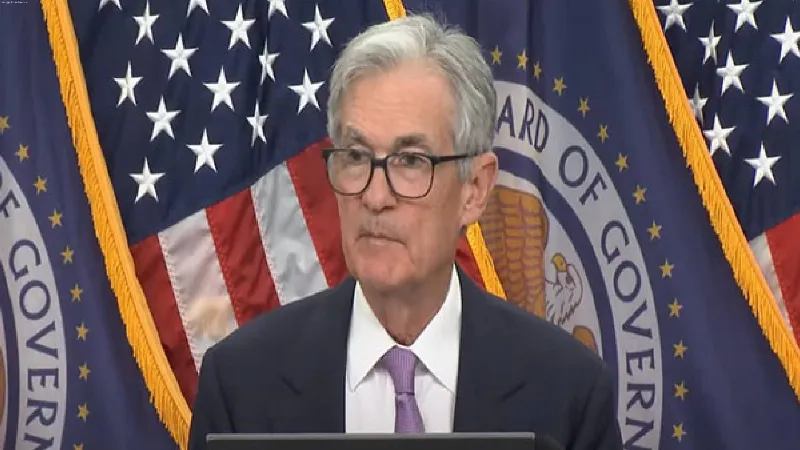

Last week, the BSE index surged by 1,653.38 points (1.99%), closing at 84,544.31, while the NSE Nifty rose by 434.45 points (1.71%), closing at 25,790.95. The midcap and smallcap indices also saw gains, albeit smaller than the major indices. Notably, foreign institutional investors (FIIs) purchased shares worth Rs 11,517.92 crore, contrasting with domestic institutional investors (DIIs), who sold shares worth Rs 633.67 crore.

In the bullion market, prices for gold and silver rose significantly. The price of 24-carat gold in Jaipur increased by 850 per ten grams, reaching 76,200, while silver climbed by Rs 1,350 per kg, reaching Rs 91,250. Traders expect continued improvement in bullion prices.

Looking ahead, traders are optimistic about market growth despite potential profit booking. The enthusiasm of FIIs and the increasing investments by Indian investors through systematic investment plans (SIPs) are driving this sentiment. Shares in select sectors, particularly banking and real estate, are considered safer bets in the current climate. Stocks like Tata Steel, Yes Bank, KPIT, Escorts, Biocon, and Zomato are highlighted as potential investments, though it’s vital to recognize that even strong stocks can decline.

For those interested in initial public offerings (IPOs), two companies are launching on the main board this week, along with 14 on the MSME platform. Caution is advised due to high premiums being requested by these companies. Additionally, six new draft prospectuses were submitted to SEBI, including notable entries like NTPC Green Energy and Oswal Pump Limited.

THE VIEWS EXPRESSED BY THE AUTHOR ARE PERSONAL