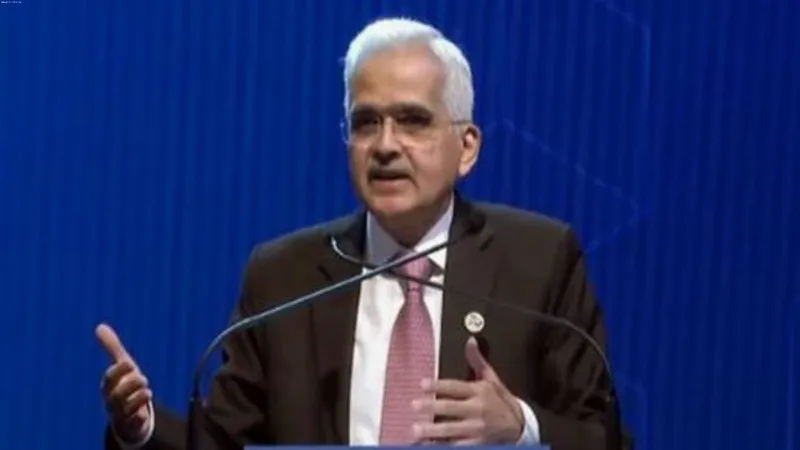

Rapid expansion of private credit market with limited regulation posing threat to financial stability: RBI Governor

New Delhi: The private credit market's rapid expansion with limited regulation is posing a threat to the overall financial stability of the system, highlighted RBI Governor Shaktikanta Das on Monday.

The Governor made this observation during his address at the 90th High-Level Conference organized by the Reserve Bank of India in New Delhi.

"Private credit markets have expanded rapidly with limited regulation. They pose significant risks to financial stability, particularly since they have not been stress-tested in a downturn," said Das.

He expressed concern that these markets could be vulnerable, especially in times of economic stress or market corrections.

Das further explained that rising interest rates, aimed at controlling inflation, have increased debt servicing costs, created financial market volatility, and heightened risks to asset quality. He noted that stretched asset valuations in some regions could trigger contagion across financial markets, exacerbating financial instability.

He said, "higher interest rates, aimed at curtailing inflationary pressures, have led to increase in debt servicing costs, financial market volatility, and risks to asset quality."

Additionally, the Governor also warned that corrections in commercial real estate (CRE) prices in some areas could put small and medium-sized banks under stress, given their significant exposure to this sector. The interconnectedness between CRE, non-bank financial institutions (NBFIs), and the broader banking system amplifies these risks, potentially leading to wider disruptions in the financial sector.

Das also highlighted the evolving role of central banking, proposing that it will be redefined in three key areas: monetary policy, financial stability, and the adoption of new technologies. He noted that these elements will shape the future of central banking as economies navigate through global financial uncertainties.

On a positive note, Das pointed out that India has developed a world-class digital public infrastructure (DPI), which has enabled the creation of high-quality digital financial products.

These advancements offer immense potential for cross-border payments, providing India with a competitive edge in the global financial ecosystem.

"India is now home to the world's third most vibrant startup ecosystem, with over 140,000 recognised startups, more than a hundred unicorns, and over USD 150 billion in funding raised" added Das.