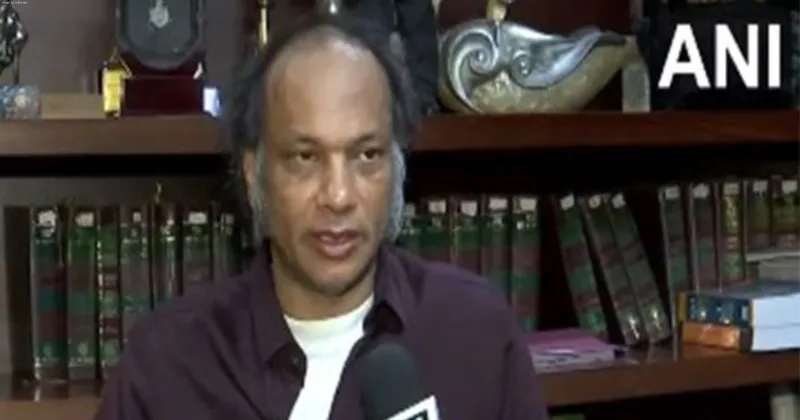

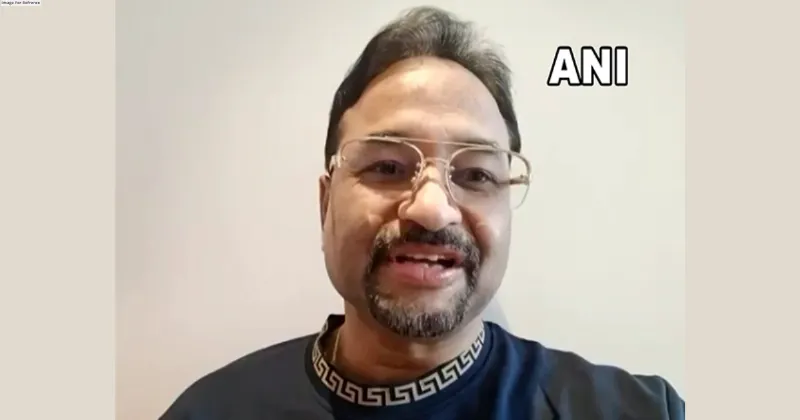

New Delhi: Paytm founder, Vijay Shekhar met with Union Finance Minister Nirmala Sitharaman on Tuesday and discussed the ongoing issue of the company, sources said.

Paytm spokesperson said, "Over the last two years, we have been working with multiple third-party leading banks. We are expanding these relationships, and they are progressing positively. We continue to operate (and have been in the past) with not just one partner but multiple banking partners for a host of services including Paytm QR. In the instances where our associate Paytm Payments Bank operates as a back-end bank, these services can seamlessly be transitioned to other partner banks. This means that for our merchant partners, there will be no disruptions, no need to revisit existing setups, and no additional effort. They can continue using our pioneering, Made-In-India Paytm QR codes, Soundbox, and card machines as before."

"We are actively engaging with our vast network of merchant partners and it's heartening to see their unwavering support and faith in us. They understand that Paytm QR, Soundbox, and card machines will continue to function as usual. We are onboarding more merchants and also observing a consistent pattern in customer behaviour, with no shift in their preference for using Paytm for payments. Paytm is committed to compliance with all regulatory directives while continuing to offer innovative, secure, and seamless digital payment solutions to millions across India. We remain focused on our mission to empower businesses and consumers alike, reinforcing our role as a leader in India's digital payments landscape."

The company, earlier said that it filed a specific clarification on Sunday, categorically denying any investigation by the Enforcement Directorate on OCL, our associates, and our management.

"We have since seen additional media reports making baseless speculations about investigations of the company or its associate Paytm Payments Bank Limited (PPBL) for violation of foreign exchange rules," it said, adding that Paytm will continue to post such clarifications as required.

In its release, the company said, "To address the recent misinformation, factual inaccuracies, and speculation, One97 Communications Limited (OCL / Paytm / Company) would like to set out the company's position and directly address rumours in the recent misleading media reports about the company and its associate, Paytm Payments Bank Limited (PPBL / Bank). This filing is done in the interest of transparency and protecting our reputation, customers, shareholders, and stakeholders from being influenced by unwarranted and speculative stories. We will continue to post such clarifications as required."

The company, in its release, further stated, "Categorically deny any investigation by the Enforcement Directorate on OCL, our associates, and/or its Founder and CEO for anti-money laundering activities Neither the company nor its founder and CEO are being investigated by the Enforcement Directorate regarding, inter alia, money laundering. In the past, certain merchants/users on our platforms have been subject to inquiries, and on those occasions, we have always cooperated with the authorities. During any such investigations by the authorities on any set of merchants/users in the past, we have cooperated with them on these investigations. This has been previously disclosed to the stock exchanges."

The release added, "We would like to set the record straight and deny any involvement in anti-money laundering activities. We have and continue to abide by Indian laws and take regulatory orders with utmost seriousness. There are other stories in various media, including social media, which are spreading speculation and misinformation on the reasons for

RBI action on Paytm Payments Bank. The recent direction from RBI is a part of the ongoing supervisory engagement and compliance process. For this action, we refer our stakeholders to the official press release of RBI dated January 31, 2024 and not rely on unofficial sources."

The release further stated, "We are exploring all options to ensure that our stakeholders are protected from unwarranted and speculative stories."