Patience is key in the current times instead of new investments

The new calendar year is set to begin this week, but in the current stock market situation, investors are advised to exercise patience instead of making new investments. However, it is also hoped that, like last year, the Indian stock market will successfully increase the value of invested capital this year as well. The policies made after the US President Trump’s oath on January 20 will determine this.

The benefit of Trump’s policies to specific sectors and the ability of companies in those sectors to capitalize on them will drive the market’s direction, which could be either positive or negative. December was not considered good for the Indian stock market due to international fluctuations, which affected investors’ confidence. However, investors who invested patiently in their preferred companies found last week to be a source of renewed hope. Although the market situation last week remained flat, it successfully recovered from the bearish grip. Despite the monthly expiry in the futures market, there was an improvement on a weekly basis, and the Nifty index closed above the support level on a technical basis. However, a concern for investors is the lack of change in the situation regarding Foreign Institutional Investors (FII) selling. Last week, FIIs sold Rs 6,322.88 crores, while Domestic Institutional Investors (DII) bought Rs 10,927.73 crores, helping stabilize the market, which was reflected in the index. Since this week marks the beginning of the new calendar year, and foreign institutional investors will return after the Christmas holidays by January 5, it can be said that there may not be any major movement this week.

However, it is certain that based on a strong economy, the Indian market will succeed in attracting FIIs again, opening a new path for market growth. If we study the current market situation, due to recent fluctuations, shares of several fundamentally strong companies are available at attractive prices. Investors should focus on these after analyzing their third-quarter earnings and seeking professional advice. They should not miss out on partial investment opportunities whenever available. Last week, the BSE index improved by 657.48 points (0.84%) and closed at 78,699.07 points, while the NSE Nifty index improved by 225.90 points (0.95%) and closed at 23,813.40 points.

The improvement in the market affected the Midcap and Smallcap indices as well. Interestingly, these two indices closed with slightly less improvement compared to the main index, indicating a flat market trend for now. However, it is certain that whenever the market picks up, the first gains will come from Midcap and Smallcap stocks. Regarding the bullion market, due to weakness in international markets, gold and silver also showed a downward trend. Last week in Jaipur’s Sarafa market, 24-carat gold prices improved by Rs 200 per 10 grams, rising to Rs 78,500 per 10 grams, compared to Rs 78,300 per 10 grams last Saturday. Similarly, silver prices improved by Rs 400 per kilogram, rising from Rs 89,600 per kilogram to Rs 90,000 per kilogram.

(These are the author’s personal views.)

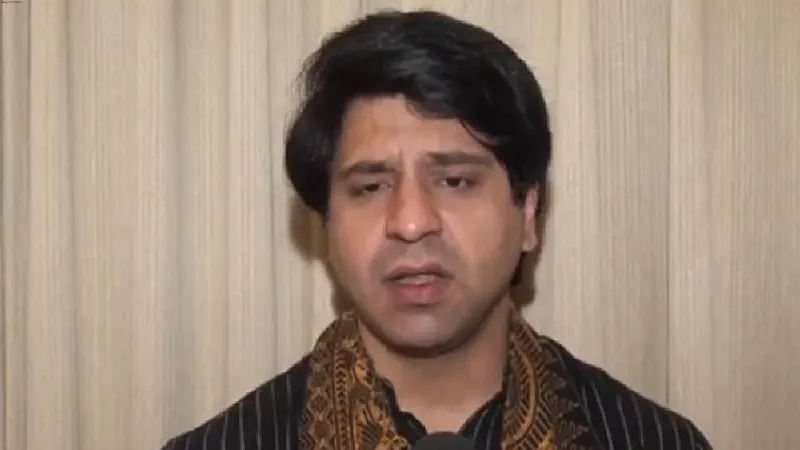

Vimal Kothari, Associate Editor, First India News & Senior Journalist