New Delhi: Stock market indices were largely steady at the opening bell Tuesday.

Indices Sensex and Nifty were a tad shy above their yesterday's closing at the time of filing this report.

On Monday, the stock indices closed with a marginal dip after both indices touched an all-time high earlier in the day. The Sensex touched a record high of 77,079 and the Nifty 50 reached 23,411 points.

"Thus, although the broader trend remains positive, some consolidation or pullback move cannot be ruled out to cool-off the overbought set ups," said Ruchit Jain, Lead Research, 5paisa.com.

Now, market participants await US May inflation data and Federal Reserve's policy decision this week. Besides, they await India's inflation data and will actively monitor policy decisions of the new government.

India's retail inflation eased to 4.83 per cent in April, down from 4.85 per cent in March. However, consumer food price inflation surged to 8.70 per cent from 8.52 per cent last month. The retail inflation in India though is in RBI's 2-6 per cent comfort level but is above the ideal 4 per cent scenario.

Nirmala Sitharaman, who has been again allocated the the finance ministry portfolio, may be welcomed by the investors community. Her full Budget for 2024-25 expected very soon will be widely watched.

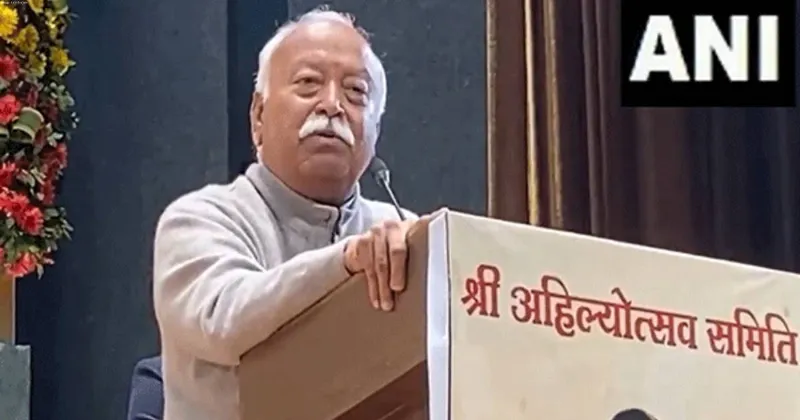

"FIIs (foreign investors) turning buyers during the last two days and covering their shorts will support the market in the near-term," said V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

Foreign buyers were net sellers in April and May, cumulatively, data showed.

"BJP keeping the key portfolios signals continuity in policies. This is a positive from the market perspective."

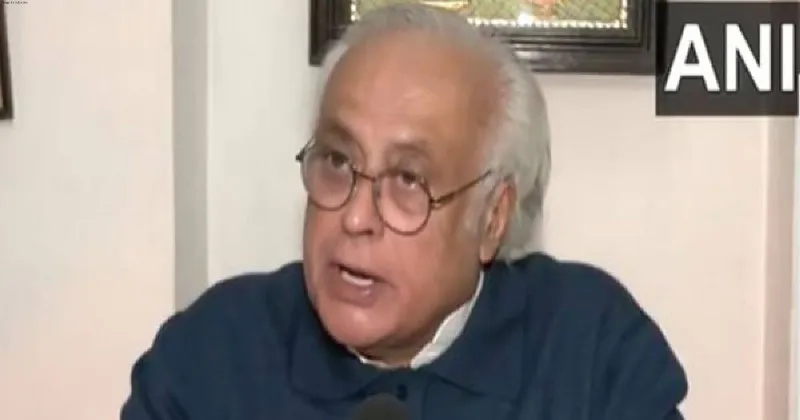

"Investors are now awaiting US Fed and BoJ policy outcome this week along with US and India CPI data. Thus market is likely to consolidate this week till the clarity emerges," said Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services.

Indian stocks witnessed a bloodbath on the day the Lok Sabha results were announced, where incumbent BJP performed below par and seemed it may fall short of exit poll predictions and the majority mark on its own. The national democratic alliance (NDA) though managed to get a comfortable majority, eventually.

Many investors booked their profits they accumulated from the gains they made a day after the exit poll predictions indicated comfortable majority for BJP.

All of the losses incurred on June 4 have been recovered over the next couple sessions and the indices are again at their record highs. A smooth transition in the government formation seemed to have boosted market sentiments.

Aries

Today brings opportunities for growth, but you'll need to stay focused. Trust your instincts to navigate challenges.

Pisces

Your intuition will guide you. Trust your feelings and explore creative outlets for peace of mind.

Aquarius

Innovation is your theme today. Explore unconventional ideas to solve lingering problems.

Capricorn

Hard work pays off today. Your dedication and discipline will lead to well-deserved recognition.

Sagittarius

Adventure is calling! Embrace new opportunities, but keep a balanced approach to risks.

Scorpio

Your determination will be unmatched. Dive deep into tasks, but don't forget to take breaks to recharge.

Libra

Harmony in relationships is your priority. Compromise and understanding will strengthen your bonds.

Virgo

Focus on organization and details. A well-planned day will lead to productive results and personal satisfaction.

Leo

Leadership will come naturally. Take charge of situations but remain humble for the best outcomes.

Cancer

Emotional balance is key today. Spend quality time with loved ones to find comfort and clarity.

Gemini

Today is perfect for networking and sharing ideas. Your adaptability will help you tackle unexpected changes with ease.

Taurus

Patience will be your strength today. Financial matters might need attention, so think twice before making big decisions.

.jpg)