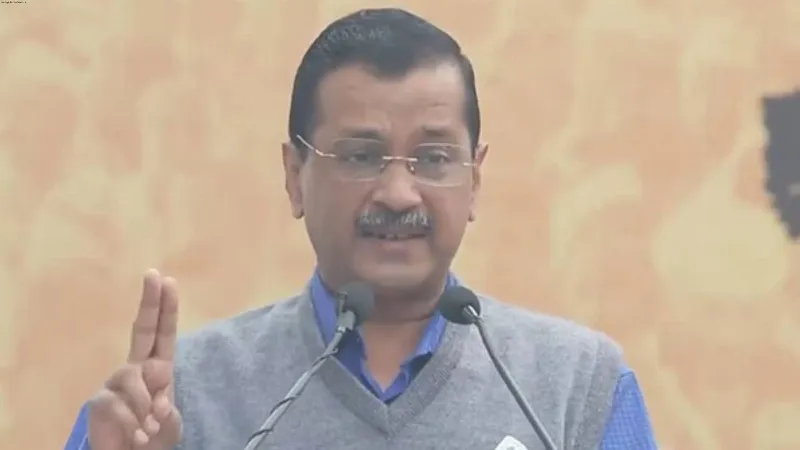

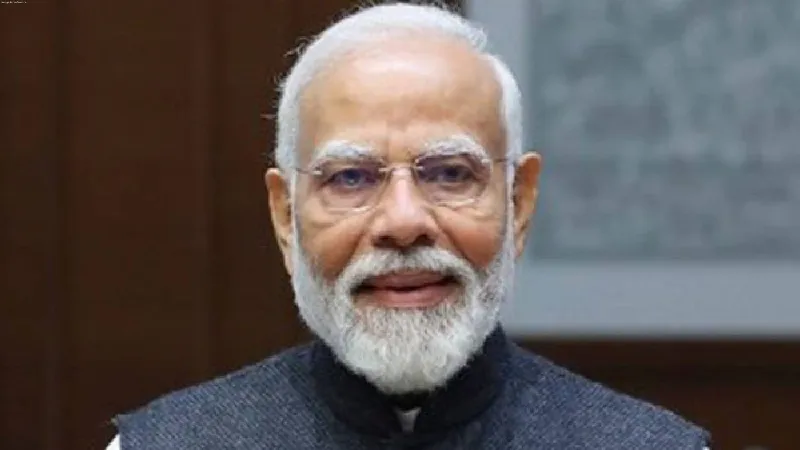

New Delhi: Delhi Chief Minister and AAP convenor Arvind Kejriwal on Friday slammed Prime Minister Narendra Modi after the Reserve Bank of India on Friday notified to withdraw Rs 2,000 denomination banknotes from circulation saying that the PM doesn't understand the pain of public which suffers due to the new policies of the government.

"First, they said the corruption will end by bringing the Rs 2000 note and banning the Rs 2000 note will end corruption. That's why we say, PM should be educated. Anyone can say anything to an uneducated PM. He doesn't understand anything. Only the public has to suffer," he said in a tweet. RBI on Friday announced that it has decided to withdraw the Rs 2,000 denomination banknotes from circulation but they will continue to remain legal tender.

RBI has advised banks to stop issuing Rs 2000 denomination banknotes with immediate effect.

Meanwhile, RBI said that citizens will continue to be able to deposit Rs 2000 banknotes into their bank accounts and/or exchange them into banknotes of other denominations at any bank branch up to September 30, 2023.

The Rs 2000 RBI on Friday announced that it has decided to withdraw the Rs 2,000 denomination banknotes from circulation but they will continue to remain legal tender.was introduced in November 2016, primarily to meet the currency requirement of the economy in an expeditious manner after the withdrawal of the legal tender status of all Rs 500 and Rs 1000 banknotes in circulation at that time.

The objective of introducing Rs 2000 banknotes was met once banknotes in other denominations became available in adequate quantities. Therefore, the printing of Rs 2000 banknotes was stopped subsequently in 2018-19, stated RBI.

About 89 per cent of the Rs 2000 denomination banknotes were issued prior to March 2017 and are at the end of their estimated life span of four-five years.

The total value of these banknotes in circulation has declined from Rs 6.73 lakh crore at its peak as of March 31, 2018 (37.3 per cent of Notes in Circulation) to Rs 3.62 lakh crore constituting only 10.8 per cent of Notes in Circulation on March 31, 2023.

"It has also been observed that this denomination is not commonly used for transactions. Further, the stock of banknotes in other denominations continues to be adequate to meet the currency requirement of the public," RBI said Friday.

"In order to ensure operational convenience and to avoid disruption of regular activities of bank branches, exchange of Rs 2000 banknotes into banknotes of other denominations can be made upto a limit of Rs 20,000 at a time at any bank starting from May 23, 2023," RBI said. (ANI)

Delhi CM Kejriwal slams Centre over decision to introduce, then withdraw Rs 2,000 note