Latest News

Indian stocks slump after four days of gains amid weak global cues

New Delhi: Snapping a four-day winning streak, Indian stock indices closed sharply lower on Thursday, primarily due to risk aversion by investors amid weak global cues.

Sensex settled at 73,730.16 points, down 609.28 points or 0.82 per cent, while Nifty settled at 22,419.95 points, down 150.40 points or 0.67 per cent. Among the sectoral indices, Nifty bank, Nifty private bank, and Nifty financial services declined the most.

This Wednesday, Indian stock indices marked the fourth straight session of gains, largely due strong domestic economic indicators. Also, improved investor sentiment with the relative easing in tensions in the Middle East and declining oil prices supported the Indian stocks.

Volatility returned in Indian stock markets after a smooth rally at the start of April. The current volatility is primarily driven by Foreign Portfolio Investor (FII) selling activity.

Foreign portfolio investors (FPIs) have turned net sellers in Indian stocks lately, as the ongoing geopolitical crisis in the Middle East likely pushed investors to take money off their portfolios. Foreign portfolio investors (FPIs), who continued to remain net buyers for the third month until a few days ago in April, have cumulatively sold stocks worth Rs 6,304 crore, National Securities Depository Limited (NSDL) showed.

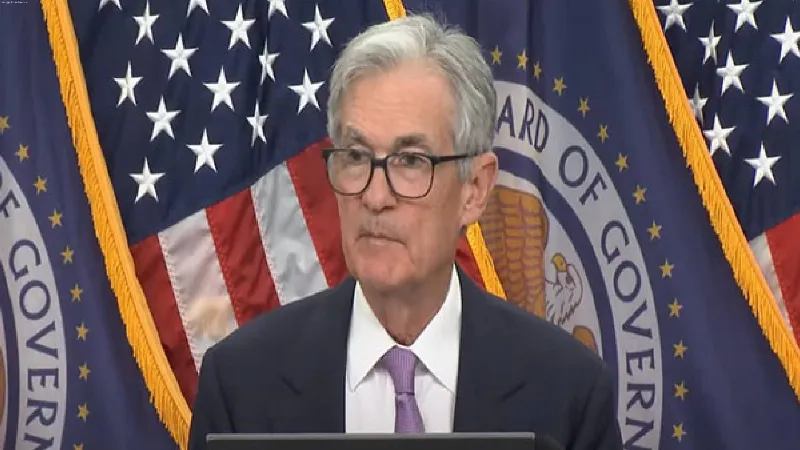

"Data from the US reflects weakening of the US economy. Q1 GDP growth has come lower than expected at 1.6% but the Fed is unlikely to cut rates in the next couple of meetings since inflation continues to remain hot," said VK Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

The US grew at an annual rate of 1.6 percent in the first quarter of 2024, which is said to be far below analysts' expectations of a 2.5 per cent rise.