Latest News

TRADERS PREDICT MARKET STABILITY AHEAD OF BUDGET

.png)

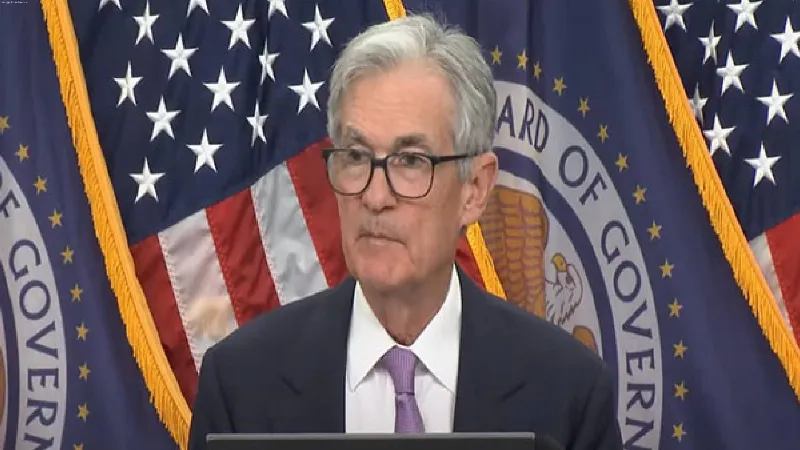

Despite the fluctuations in the stock market, the upward journey continues. Last week also, the BSE index touched a record of more than 81500 points, and this is also a record that the upward journey of the country’s stock markets continued for the seventh consecutive week and the market once again made new records. The future direction and condition of the Indian stock market will be decided in the budget to be presented in Parliament on Tuesday, 23 July. It is believed that in the budget, the government will announce policies towards promoting new investment in the country, due to which it is also being said that the government will resolve all such matters including the amendment made on July 5 regarding short term capital gain in the return filing of taxpayers who submit income tax returns, and will definitely announce positive policies to give relief to the common taxpayers and give momentum to the market. If relief is announced to the taxpayers through the budget, whether it is about changes in income tax rates, or about changes in the limit of the new tax regime, then it will definitely have a positive impact on the stock market and the market will get more momentum. Experts say that the Indian stock market is still strong from a long-term perspective, so even if the expected announcements are not made in the budget, investors should not have much doubts about the market. The biggest proof of this can also be considered to be the buying by foreign institutional investors -FIIs, which has increased significantly last week.

The rise that was seen on this day last week did not stop in the trading session ending on Friday and there was a big fall of 738.81 points, but the BSE index improved by 85.30 points (0.11%) for the entire last week and the BSE index closed at 80604.65 points after touching the highest level of 81587.76 points, while the NSE Nifty index rose by 28.75 points (0.12%) and it also closed at 24530.90 points after reaching 24854.80 points. The midcap and smallcap index also showed indifference to the improvement in the market, which can be considered a sign of weakness for the market. In the growing confidence in the Indian stock market, now foreign institutional investors - FIIs are also joining the chorus, they bought goods worth Rs 10945.98 crore last week, but on the contrary, domestic institutional investors - DIIs did not support the purchase of FIIs and DIIs sold goods worth Rs 4226.29 crore. Talking about the bullion market, this week due to the new international equations, there was almost stability in the prices of gold and silver and while the price of gold improved by Rs 200 per 10 grams this week, the price of silver fell by Rs 3250 per kg. In Jaipur, the price of 24 carat gold improved from last week’s Rs 74,900 per ten grams to Rs 75,100 per ten grams and silver fell from Rs 94,700 per kg to Rs 91,450 per kg. Traders are expecting stability in the prices of gold and silver this week as well, but if the government makes any announcement regarding the import duty on gold, then the market will see changes accordingly..

The traders anticipate market stability this week, advise long-term investments in strong firms like JK Cement, ITC, Castrol, Zomato, Kotak Mahindra Bank. IPO opportunities include Sunstar Limited and 8 MSME companies; along with new applications from Patel Retail and Sai Life Science to SEBI.

THESE ARE THE PERSONAL VIEWS OF THE AUTHOR