Latest News

MARKET POISED FOR GAINS WITH IPO SURGE

.png)

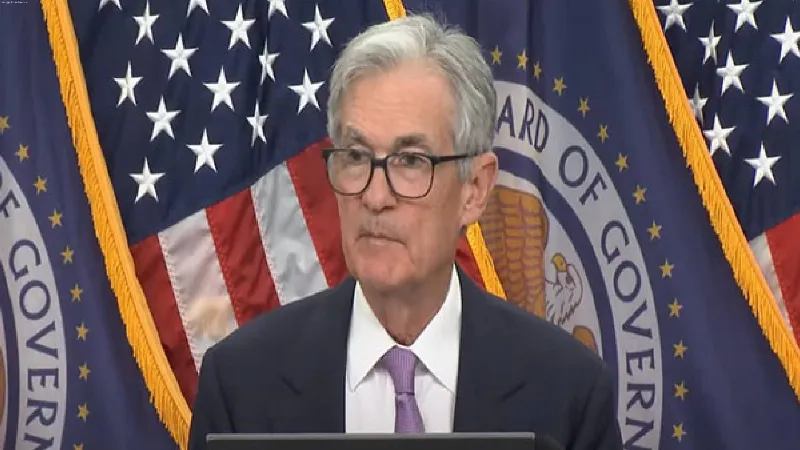

Driven by international improvements, monsoon effects, and better company results, the Indian stock market is poised for another phase of recovery. The strength of the Indian market is evident as the number of companies entering the capital market through IPOs continues to rise, potentially setting new records in 2024. Despite the upcoming monthly futures market settlement on Thursday, technical experts remain optimistic about reaching new market highs, though international conditions will play a significant role. Last week saw a continuation of gains, marking the second consecutive week of upward movement. This week, expectations are bolstered by the U.S. Federal Reserve’s interest rate cut, suggesting that last week’s bullish trend could indicate new market movements, with Indian economic strength playing a crucial role.

Last Friday, the BSE index improved by 649.37 points (0.81%) to close at 81,086.21, while the NSE Nifty index rose by 282.00 points (1.15%) to close at 24,823.15. Midcap and smallcap indices also showed better performance compared to the main indices, with smallcap stocks outperforming the main indices. Foreign Institutional Investors (FIIs) bought shares worth Rs 1,944 crore, supported by Domestic Institutional Investors (DIIs) who purchased shares worth Rs 2,896 crore. In the bullion market, gold prices rose by Rs 300 per 10 grams to Rs 73,600, while silver prices improved by Rs 2,600 per kilo to Rs 87,900. Traders expect continued improvement in gold and silver prices.

For this week, traders anticipate a technical recovery. The monthly futures market settlement on Thursday might have a limited impact. Investments in companies such as Tata Technologies, BEL, Zomato, SEAGAL, HFCL, Lenskart Holdings, Paytm, Himadri Chemicals, Delivery, and Bombay Dyeing are considered secure, but investors should be cautious as even strong stocks might not be immune to downturns. IPO opportunities include three main board companies and six MSME platform companies. Investors should be cautious of high premiums demanded by new IPOs. Additionally, SEBI has received draft prospectuses from nine companies this week, with major ones being JSW Cement and Kalpataru Limited.

THE VIEWS EXPRESSED BY THE AUTHOR ARE PERSONAL