Latest News

INDIAN MARKETS REBOUND AMID GLOBAL RECOVERY

.png)

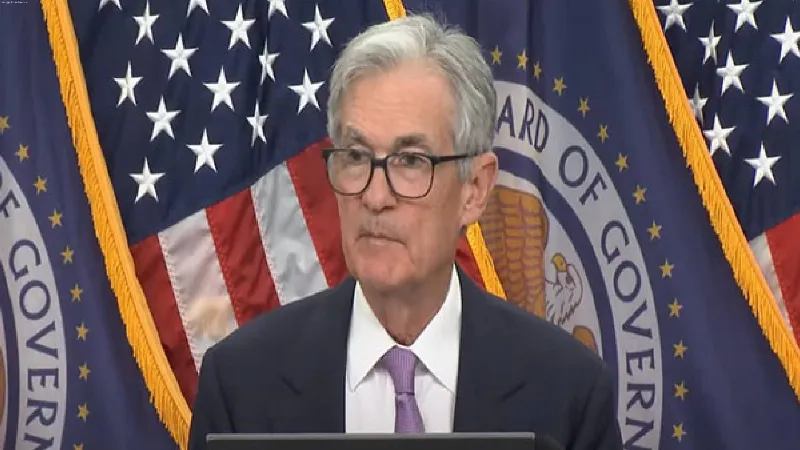

After facing a decline for the past two weeks, the Indian stock market regained momentum last week. Despite the national holiday on August 15, the markets showed improvement in just four trading days, coinciding with the gentle monsoon rains across the country. This surge in the stock market can also be seen in the context of minor global recoveries. Concerns about unemployment data in the U.S. had previously cast a shadow over global markets, but last week, some of these doubts were alleviated. There is hope that while unemployment might increase slightly, it won’t severely impact the U.S. economy. International news has reported better-than-expected U.S. unemployment benefit figures. The recent market upturn was notably significant in the IT and real estate sectors, indicating that a strong performance in the real estate sector could positively affect related industries. Technical assessments now suggest a recovery in the Indian stock market, potentially rekindling investor hope and energy. As I have mentioned before, investors should not only monitor market indices but also keep an eye on their investment portfolios. If they have studied and invested in a company based on research and confidence rather than tips, the likelihood of returns is higher. Similarly, if there is a major market decline for any reason, investing more in fundamentally strong companies can be beneficial. It is also reassuring for India that both investor interest and money in the stock market are continually increasing, which should bolster the market in the future.

Last week, the BSE index saw an improvement of 730.94 points (0.92%) and closed above the 80,000 level at 80,436.84. The NSE Nifty index rose by 173.65 points (0.71%) to close at 24,541.15. The recovery was also reflected in the midcap and smallcap indices, which showed positive trends. Last week, Foreign Institutional Investors (FIIs) sold shares worth Rs 8,616.43 crore, while Domestic Institutional Investors (DIIs) bought shares worth Rs 10,560.08 crore, balancing the FIIs’ sell-off. In the bullion market, improvements were noted due to increased buying and global market recoveries. In Jaipur’s bullion market, 24-carat gold prices rose by Rs 2,600 per ten grams, reaching Rs 73,300 per ten grams compared to Rs 71,700 per ten grams the previous Saturday. Silver prices increased by Rs 1,800 per kilogram, reaching Rs 85,300 per kilogram from Rs 82,500 per kilogram last week. Traders are hopeful for further improvements in gold and silver prices this week.

This week, traders are optimistic about a market recovery based on technical analysis. They believe that while a recovery is certain, delays and profittaking could lead to further declines. The biggest question remains how significant and how long the recovery will be, which only time will answer. The week will also start on Tuesday due to the Raksha Bandhan holiday, meaning there will be one fewer trading day. Despite this, some traders view investments in companies like ITC, Paytm, State Bank of India, BEL, TCS, Tata Motors, and DLF as secure, but investors should be aware that even strong stocks can be affected by declines. This week, investors will have the opportunity to apply for IPOs from two companies on the main board and five companies on the MSME platform. Investors should be cautious of high premiums requested by new IPOs. Additionally, three companies— Aeris Infra Solution, Adventure Knowledge Solution, and Metal Man Auto Limited—have submitted their Draft Red Herring Prospectuses (DRHP) to SEBI this week.

THE VIEWS EXPRESSED BY THE AUTHOR ARE PERSONAL