STOCK MARKETS HIT NEW RECORD HIGHS AMID INVESTOR SURGE

Jaipur: Stock markets have again set a new all-time high record last week due to all-round buying by institutional investors along with Indian investors. The credit for this boom in the stock market can be given to the continuous buying by Indian investors and institutional investors. Foreign institutional investors-FIIs, who were sellers in the stock market for a long time, bought heavily last week, although the buying by domestic institutional investors can be called weak compared to the buying done by FIIs, but they also participated in the buying and accelerated the boom in the market. The biggest basis for the boom in the Indian stock market is the strength of the Indian economy and the recent better performance results of Indian companies. In such a situation, it can be believed that the prices of shares considered fundamentally strong will continue to improve in the future, no matter what their current prices are. Technical experts are estimating that the stock market will continue to move on the path of improvement this week as well, some experts now expect the Nifty index to reach the level of 25500 points, in such a situation it can also be said that no one can stop the Indian stock from reaching a new height again. It is a different matter that the market will remain volatile due to profit booking, but this year’s Diwali will definitely light the lamps of happiness in the hearts of patient investors.

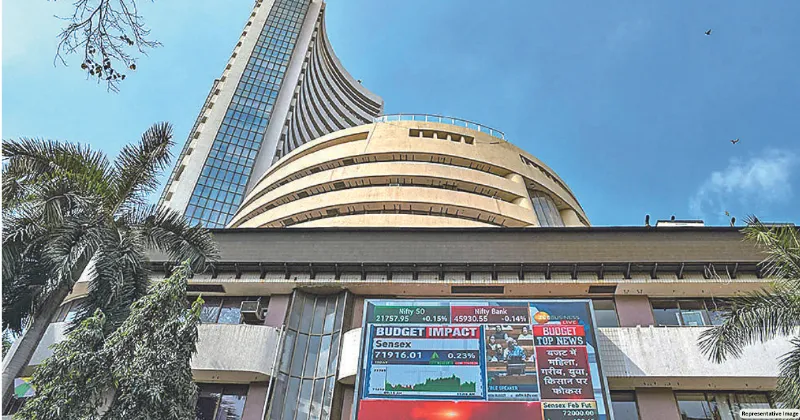

Last week ending on Friday, the BSE index improved by 1279.56 points (1.58%) and this time the BSE index achieved a record level of 82 thousand and closed at 82365.77 points, reaching the highest level of 82637.03 points in the week, while the NSE Nifty index rose by 412.75 points (1.66%) and it also closed at 25235.90 points after achieving a record level of 25268.35 points. With the improvement in the market, the midcap and smallcap index also moved in step with the improvement, but the rise in them can be said to be a little weaker than the main index. In view of the improvement in the market, last week, while foreign institutional investors-FIIs bought shares worth Rs 9217.29 crore, domestic institutional investors-DIIs also supported this purchase of FIIs and DIIs bought shares worth Rs 1198.27 crore. Talking about the bullion market, there was a period of sluggishness in the prices of gold and silver this week. In the bullion market of Jaipur, the price of 24 carat gold rose by Rs 50 per ten grams and it reached the level of Rs 73,650 per ten grams as compared to the price of Rs 73,600 per ten grams last Saturday. While the price of silver declined by Rs 1900 per kg and it fell from Rs 87900 per kg last week to Rs 86000 per kg. While traders are expecting stability in the prices of gold and silver this week, some weakness in gold is also being estimated.

Traders are expecting improvement in the market trend on technical basis this week. On technical basis, it is believed that the Nifty index can reach the level of 25500 points this week, the reason for this is believed to be the support of the index at 24900-25000. Traders are considering companies of defense, chemicals and renewable energy sector as safe in the current situation. They say that along with the index, there will be a bullish or bearish trend in the market in specific stocks, which investors should keep an eye on.

These are the personal views of the author.