Latest News

Cautious optimism as IPO buzz, uncertain trends galore Dalal Street

Jaipur: The festive atmosphere of Diwali across the country is set to conclude early this week, bringing normal business activities and a return to traditional patterns in the stock market. In the Diwali muhurat trading, both Nifty and BSE indices showed strength, disappointing investors who expected a downturn, while traditional stock traders found relief in the upward trend. This reflects the saying that ‘Kahin Deep Jale, Kahi Dil’.

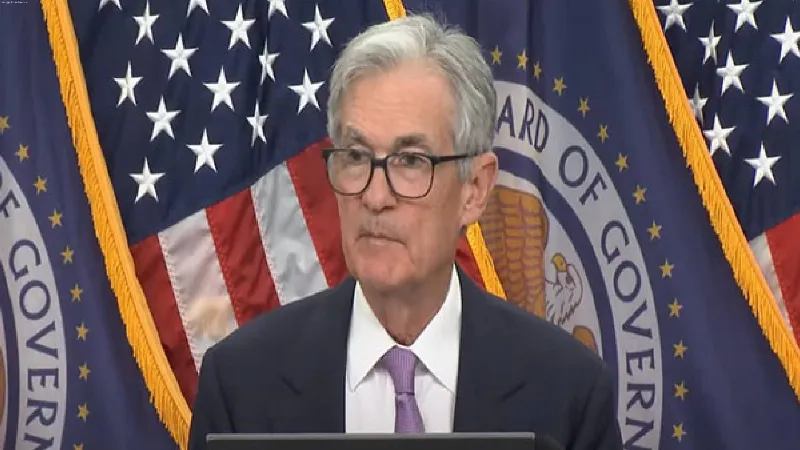

As the stock market opens on Monday, it is possible that foreign institutional investors (FIIs), who sold shares worth Rs 1,14,445.89 crore in October, may resume selling. However, domestic institutional investors (DIIs), who made purchases worth Rs 107,254.68 crore in October, might take a stand to push the Indian stock market back towards a bullish trend. Based on technical analysis, it can be said that the current situation remains unclear; the market’s direction will depend on the voting in the U.S. presidential election on November 5 and decisions from the U.S. Federal Reserve regarding interest rates. If the market does decline, it could present a buying opportunity for investors looking to benefit from long-term investments. Currently, Nifty is fluctuating within the range of 24,000 to 24,500, and until it breaks out of this range, a clear market trend cannot be established.

Notably, this week, five companies are set to launch their IPOs, including Swiggy and Niva Bupa Health Insurance. Swiggy’s IPO, valued at Rs 11,327.43 crore with a price band of Rs 371 to Rs 390, has reportedly seen its anchor investors’ portion receive applications up to 25 times. Niva Bupa, previously known as Max Bupa, has yet to announce its issue price but is expected to be at a significant premium.

Last week, the Indian stock market successfully recovered from a weekly decline, breaking a fourweek losing streak, largely thanks to the surge during Diwali muhurat trading. Since the market direction is still uncertain, savvy investors should proceed with caution and focus on high-quality stocks in their portfolios to take advantage of any market recovery. Last week, the BSE index improved by 321.83 points (0.41%), closing at 79,724.12 points, while the NSE Nifty index rose by 123.55 points (0.51%), closing at 24,304.35 points. The recovery in the market had a profound impact on the midcap and small-cap indices, showing greater gains compared to the main indices.

Last week, in Jaipur’s jewelry market, the price of 24-carat gold fell by Rs 100 per ten grams, reached Rs 80,800 compared to Rs 80,900 the previous Saturday. Silver prices dropped by Rs 3,000 per kilo, falling from Rs 100,000 to Rs 97,000 per kilo.

Stability in gold and silver prices is anticipated this week.